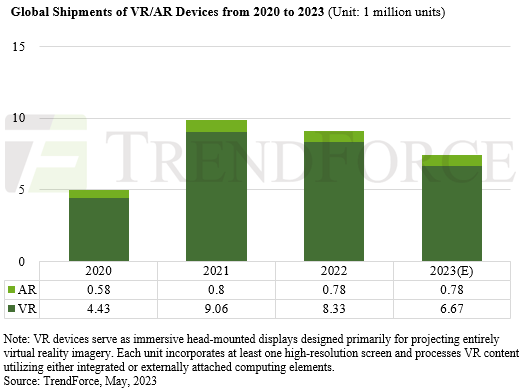

AR unit shipments will stay stable at 780,000 units.

The predicted fall for VR units is because of weaker-than-expected sales of newly released high-end devices.

Consequently, manufacturers are likely to pivot their sales strategies, shifting their focus to more cost-effective offerings.

While Apple’s latest offerings could stimulate some demand, the high price tags attached to these units continue to pose a significant barrier to broader market growth.

MetaQuest 2 continues to maintain its status as this year’s market-leading VR product as the release of Meta Quest 3 has been pushed back to 2024.

Although Apple is projected to launch a new product in 2023, this release is primarily targeted at developers, signifying an accompanying escalation in specifications, features, and, most importantly, cost.

TrendForce anticipates that a significant rise in the VR and AR market, potentially nearing a 40% annual increase in shipments, might not be realized until 2025

IDC reckons the 2023 European AR/VR market will be worth $1.1 billion and $3.4 billion respectively rising, by 2027, to a collective $10.5 billion, with a 2022-6 CAGR of 24.9%.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News