Under the ‘Made in China’ programme, China has a goal to be supplying 70% of its domestic market by 2025.

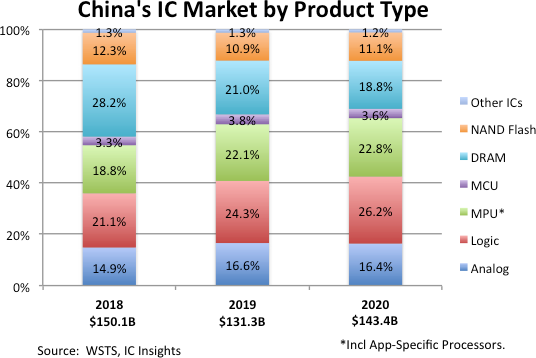

Sales of logic ICs accounted for the largest share of China’s IC Market in 2020 with MPU and DRAM rounding out top three product categories in the China market, concludes IC Insights in its 2021 edition of The McClean Report.

The report analyses regional IC marketshares, including a split of the China IC market by product type.

China became the largest IC market in the world in 2005 and has continued to grow in size since then

In 2020, the Chinese IC market increased to $143.4 billion, a 9% gain from $131.3 billion in 2019.

IC Insights estimates that 60% ($86.0 billion) of China’s $143.4 billion IC market was integrated into an electronic system that was exported while 40% of its IC market ($57.4 billion) was used in systems that remained in the country.

Figure 1 shows the split of China’s IC market by product type.

Leading the way were sales of logic devices, which accounted for 26% ($37.5 billion) of China’s IC market last year.

IC Insights forecasts the logic market will remain China’s largest IC product segment through 2025, maintaining a strong CAGR of 10.5% through the forecast period.

Strong sales of smartphones in China and throughout the world along with an uptick in sales from various computing systems during the virus-plagued year resulted in microprocessors being the second-largest IC product segment in China last year.

MPU sales in China, including revenue from application-specific processors, grew 12% in 2020 to $32.7 billion.

With 19% share, DRAM was the third-largest IC market in China last year.

In 2020, the DRAM and NAND flash memory markets together accounted for 30% of China’s total IC market.

The high level of memory consumption in China is helping fuel the country’s burning desire to create an increasing amount of indigenous production of both DRAM and NAND flash devices.

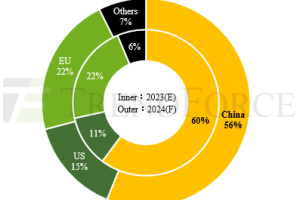

There is no denying the long-term trend toward increasing IC marketshare in China and the rest of the Asia-Pacific region.

China and Asia-Pacific are forecast to increase their combined share of the worldwide IC market from 63.8% in 2020 to 68.1% in 2025, which represents a CAGR of 9.4% over this time period.

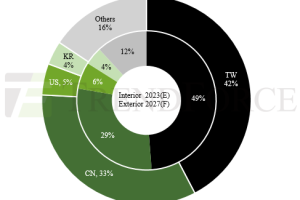

While China has been the largest consuming country for ICs since 2005, the nation is not necessarily a major producer of ICs now, and it may not be in the future.

Of the $143.4 billion worth of ICs sold in China in 2020, only 15.9%, or approximately $22.7 billion, of it was produced in China last year.

Of that amount, China-headquartered companies produced only $8.3 billion, accounting for only 5.9% of the country’s total IC market last year.

Foreign companies with wafer fab operations in China (e.g., TSMC, SK Hynix, Samsung, UMC, etc.) still account for much of China’s IC production.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News

Of the 150 billion of IC Chinese market,143 billion are imported, of that, a good percentage is consumed by foreign manufacturing companies outsourcing electronics in China, that will never change. 16% is manufactured inside China by local fabs regardless of the company origin and 6% is made by fabs of companies originated in China.

What will be really interesting will be to see the consumption of local made components by Chinese companies, How many of the imported IC are designed in China and manufactured elsewhere, how is trend is changing. This report says nothing about that. Well good reading nevertheless.

Thanks Dave, I’ve corrected the headline.

Incorrect title or first line: Title should say 5.9%??

Ha Ha Malcolm, how very true, but we don’t see 23 Province as a province of China and, what’s more important, the US Seventh Fleet doesn’t either.

If you include IC production from the ’23 Province of China’, that 70 percent number is already reached … it’s just a matter of when ROC ‘turns in its chips’ (literally)