GaN is used in RF power devices that boost the power levels for wireless transceivers.

By the end of 2017, the total RF GaN market was just $380m, but according to a new report by Yole Développement, the penetration rate in various markets, and in particular wireless telecoms and defence applications, had a breakout period in the last two years.

Yole said the CAGR in these two markets is more than 20%.

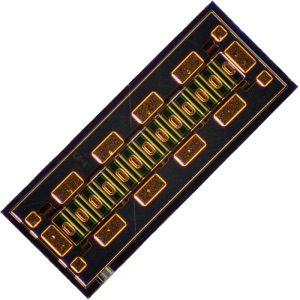

Wolfspeed 25W 18GHz GaN HEMT Die

While the defence market has been the major driving force for GaN development in the past, this could change with the emergence of 5G network technology, and this will start in 2018.

“The total RF GaN market size will be a factor of 3.4 larger by the end of 2023, posting a 22.9% CAGR from 2017-2023,” predicts Yole.

The main GaN device suppliers are Sumitomo, Qorvo and Cree, but according to Yole, the industry is at a critical stage.

After the failed acquisition by Infineon, Wolfspeed is now integrated into Cree’s business.

Ampleon announced an acquisition offer by a Chinese LED company, named Aurora Sapphire. This company is a competitor of San’an Optoelectronics.

Yole, writes:

“In addition, companies like M/A-COM and Sumitomo have begun using silver sintering as the die attach material, it helps thermal control and improves the device quality. It’s been confirmed that next step will be using pure copper as flange material for the package.”

Compared to existing silicon LDMOS and GaAs RF device technology, GaN devices can have both power/efficiency for high frequency architectures proposed for 5G.

Yole, writes:

“GaN HEMTs have been the candidate technology for future macro base station power amplifiers. We estimate that most sub-6GHz macro network cell implementation will use GaN devices because LDMOS can no longer hold up at such high frequencies and GaAs is not optimum for high power applications.”

However, because small cells do not need such high power existing technology like GaAs still has advantages.

In military systems GaN devices have been implemented in new generation aerial and ground radars.

This military-related technology is very sensitive and governments could block deals if businesses target military applications, as in Aixtron’s acquisition by FGC Investment Fund, or Wolfspeed’s by Infineon.

“GaN RF has been recognised by the industry and has become mainstream”, asserts Zhen Zong, Technology & Market Analyst at Yole. “Indeed, leading players are increasing revenue very rapidly and this trend will remain for the next several years.”

GaN transistors price is still relatively high and this will only fall if more players should penetrate the market.

Also new technologies in the package material and die attach will be more frequently used in higher-frequency and higher-power applications.

“Indeed, we believe it will help reduce the price and ameliorate the performance”, said Zong.

Yole’s report is titled “RF GaN Market: Applications, Players, Technology, and Substrates 2018-2023”.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News