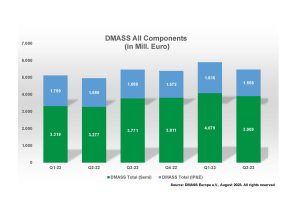

In Q2, the IPE sector dropped 7% to €1.56bn although the broader European components distribution market grew by 10% while the semiconductor sector increased by 19% to achieve €3.91bn.

For the good news story of semiconductors, DMASS reported over-proportional growth in Germany (30%), Italy (25%), France (19%), Austria (23%) and Turkey (26%) with double digit growth in the UK (13%), Switzerland (10.5%), Iberia (12%), Nordic (16%) and Eastern Europe (14%). In terms of product categories, microcontrollers, programmable logic and power discretes saw the most growth.

DMASS explained that IPE was ahead of semiconductors in seeing a return to normal market conditions. The decline was not across all regions, however, with the UK and France performing above average with +1.6% growth and -2% change respectively. Germany saw a 7% decline but Italy and Ireland saw declines of 11% and 13% respectively. Passives declined at an average level, electromechanical components, which includes interconnects, fell by nearly 9%. The only gain was in power supplies (+3.66%).

DMASS chairman, Hermann Reiter said that the figures “cannot hide the fact that customer orders have continued to slow down, which will inevitably result in a weaker second half of the year. Inventories are full and need to be digested. At the same time, availability across the market has improved significantly and instances of components shortages, while still present – for example SIC- and GaN-Devices – have reduced a lot.

“The awareness of the significance of a steady supply chain has never been higher . . . the conditions of trade have turned almost from free market to delay management and to some conditions that certainly were hard to swallow. Therefore, it is more important than ever to co-operate better in the supply chain to at least mitigate the potential risks and find better solutions. The future of the components industry, while looking generally positive, depends on a variety of massive challenges that can turn the market either way. We must get prepared for that.”

Reiter added that he is hopeful that the market will return to “some normality”: “We are convinced that the long-term demand is not hampered, and design activities remain dynamic among all the challenges,” he said.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News