Beginning the briefing with a reference to the Hitchhiker’s Guide to the Galaxy, Aubrey Dunford, market analyst at ECSN (pictured), declared that for the UK components distribution market, things are back to normal. Quoting HHGTTG’s Trillian Astra, as the spaceship re-emerged from the infinite improbability drive: “We have normality. I repeat, we have normality. Anything you still can’t cope with is therefore your own problem”.

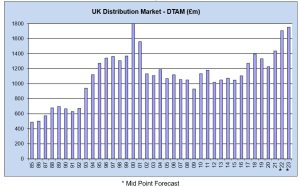

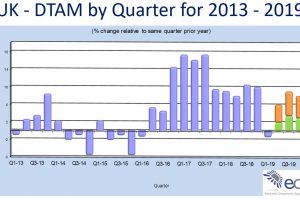

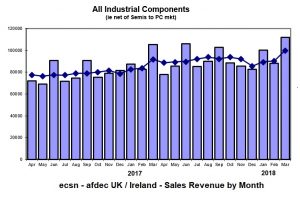

Research based on interviews, questionnaires and data from other trade organisations, the trade body for electronic components suppliers was in – mostly – positive mood, predicting growth in the dtam (distributor total addressable market) would grow over the next two years, dominated by semiconductors. For the UK and Ireland it described the market as positive with component market sales of £1.7bn in 2022 and £1.75bn in 2023. Although tam will drop back as product from the grey market falls away.

Growth in the first half of 2023 is predicted to be 3.5-6% but in the second half of the year there is expected to drop but growth still just under 3%.

The biggest casualty is likely to memories, used in phones and computers, sales of which rely on consumer confidence. This sector is expected to decrease by 17% in 2023. In contrast, discrete and optoelectronics are predicted to increase by 2.8% and 3.7% respectively, according to World Semiconductor Trade Statistics.

The industry will have to contend with several factors next year, and beyond.

Members believe that 2023 will continue to see growth in the UK market “although not at the rate seen in the past two years,” according to Dunford.

Globally, order books are inflated but European data suggests that over-inflation in the areas which affect the UK (discretes and optoelectronics) is limited. The only question is how much will remain when availability improves. There needs to be a managed drop in the advanced inventory, says ECSN’s chairman, Adam Fletcher. There may be as much as 25% of the book to bill ratio being double ordering, he speculates. Managing the inventory will keep inventory levels relatively low.

Pricing is expected to remain at 2022 levels next year and ECSN members expect that growth will continue throughout the first half of the year and a fall in book to bill ratios as lead times return to more normal levels, albeit with some component shortages even as the global market declines.

Consumer confidence is dropping but new projects using electronics, such as infrastructure improvements, edge computing and the 5G roll-out may boost demand and partly compensate for low consumer confidence restricting spending. Political and trade tensions around Ukraine-Russia, US-China and China-Taiwan are not expected to be resolved quickly and the 2024 US presidential campaign will be in full swing at the end of 2023, adding further uncertainty. Dunford said that customers will be confident when leads time are reduced. There are indications that manufacturing is improving but ECSN’s customers may hold more inventory due to lack of consumer confidence next year.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News