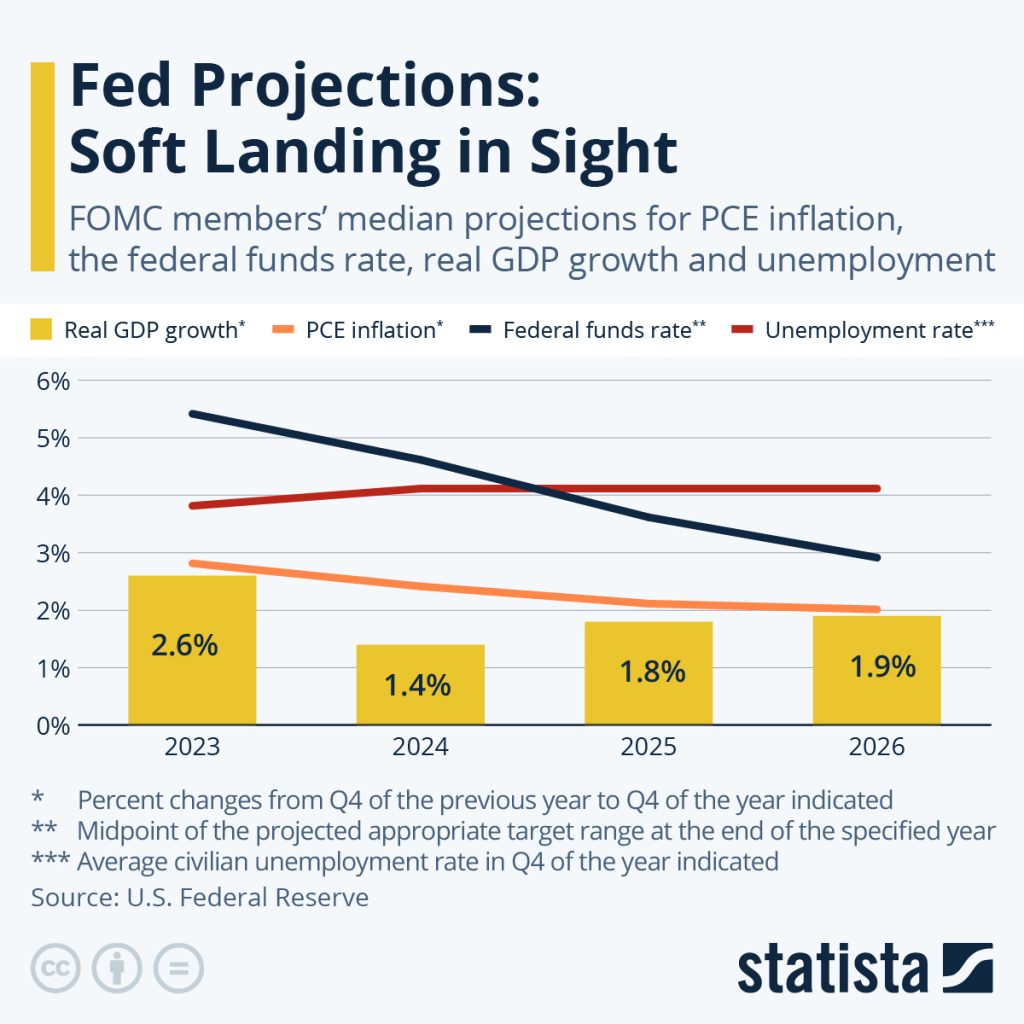

With CPI inflation down to 3.1% in November, the unemployment rate still hovering below 4% and U.S. GDP on track to grow 2.5% this year, the often-quoted ‘soft landing’ is in sight.

According to the FOMC’s (Federal Open Market Committee) Summary of Economic Projections, the median projection for the appropriate level of the federal funds rate at the end of 2024 is now 4.6% meaning that members of the are currently expecting three 0.25 percentage point rate cuts for next year, followed by further cuts throughout 2025 and 2026.

Looking at the price index for personal consumption expenditure (PCE), FOMC members expect inflation to drop from 2.8% in Q4 2023 to 2.4% in Q4 2024, 2.1% in Q4 2025 and return to its target level of 2% by the end of 2026.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News